Introducing the State of the Brand NFT 2022 Report

Exciting news, everyone! We are thrilled to announce the launch of the State of the Brand NFT 2022 Report. This comprehensive report delves into the world of the brand NFT market of last year, providing an in-depth look at how brands have entered the space, launched their own NFT collections, and how the market has evolved over time.

In this report, you will find information on the latest trends and developments in the brand NFT space, as well as revenue deep dives and insights into how brands are leveraging this new technology to drive growth and engagement. Whether you're a brand looking to enter the NFT market, a Web3 advisor/consultant or a curious observer, this report is a must-read for anyone interested in the future of digital ownership and the role of brands in the web3 ecosystem.

The report is available. Don't miss out on this opportunity to learn more about the world of brand NFTs and how they are shaping the future of digital ownership. Thank you for your continued support and we look forward to sharing our findings with you!

We would like to thank all the experts and contributors who helped shaping this report and provided their perspective on the State of the Brand NFT 2022.

Key Highlights

Despite the Web3 downturn, 2022 has seen institutional adoption across major brands launching NFT collections

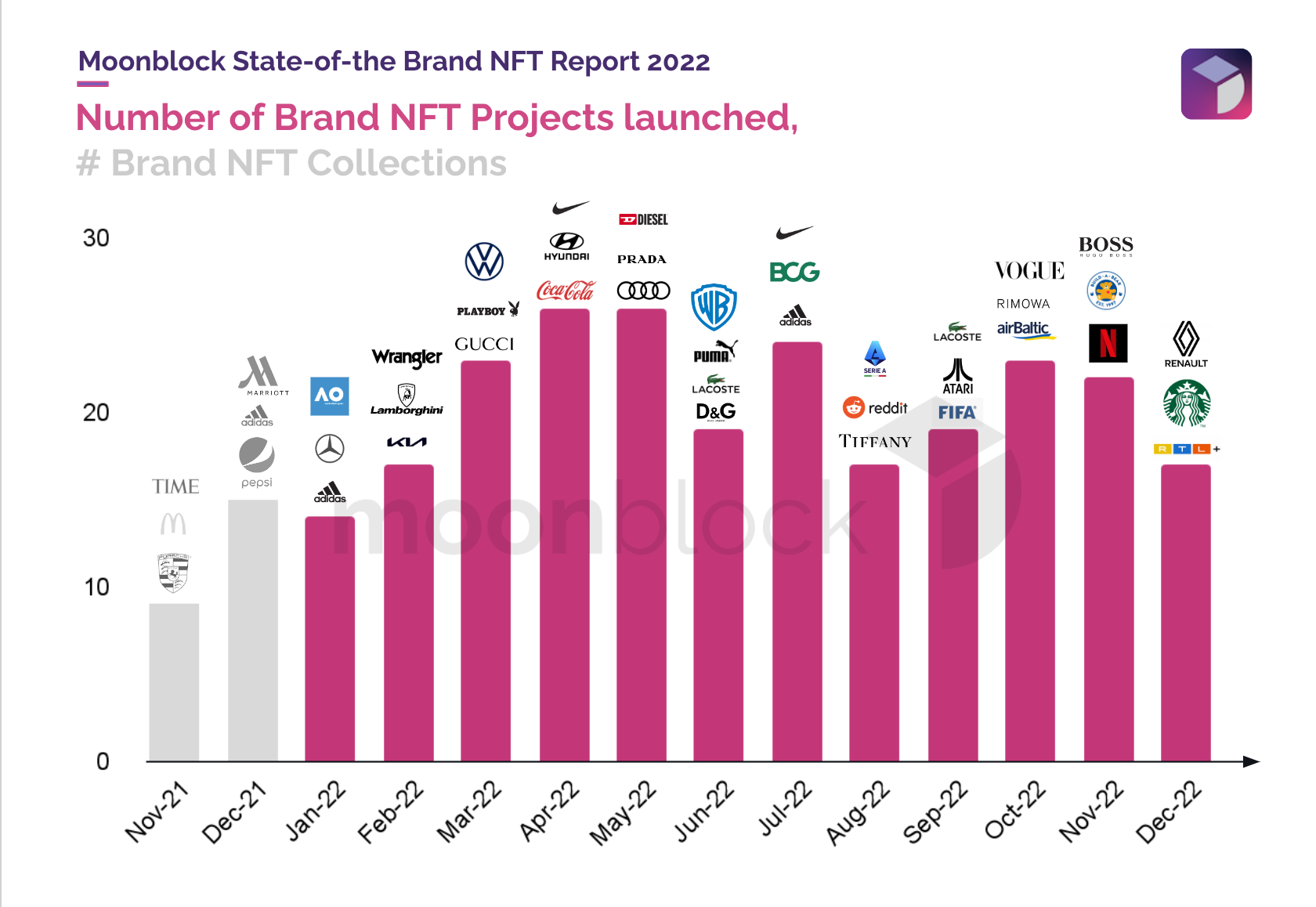

Despite the crash of Terra in May 2022 and the subsequent Web3 downturn, brands continued their efforts and initiatives in the NFT space throughout the year, especially toward the end of 2022. This suggests that brands are committed to exploring NFT use cases and that volatility does not deter their longer-term aspirations in the field. The brand's long-term aspirations in the field are also underscored by the fact that brands are exploring more sophisticated use cases instead of purely collectibles and moving away from stand-alone experiments. Examples of the more sophisticated use cases include Starbucks loyalty and membership program, Warner Brothers’ Lord of the rings collection (token gated movie content), Adidas’s phygital products and alike.

47% of the brand NFT projects launched were first-time NFT collections while the remaining 53% projects came from brands continuing their journey in Web3

More than half (53%) of the brands that launched a collection in 2022 had previously already launched a collection. The high rate of brands launching a follow-up collection lends support to that brands see a strong potential for NFT use cases in their ways of connecting with their current and future customer bases as well as that brands likely are moving away from one-off NFT projects, indicating a professionalization of brands NFT efforts.

Institutional NFT adoption in the brand and enterprise space tapped into almost every industry

We have seen (at least) 161 brands launching 247 brand NFT collections in 2022. While these numbers are impressive by themselves, the fact that the brands span various different industries underscores the importance of NFTs for brands across segments.

Despite collections originating from diverse industries, most collections stem from fashion and entertainment & media (71 and 55 collections respectively). This might not be all too surprising. What, however, might be surprising is that more collections originated from the technology industry than from the beauty and cosmetics industry. Another insight uncovered in our work is that multiple collections were launched in the consumer goods and retail, hospitality and professional services, as well as that multiple major brands, such as Puma, Starbucks and Tiffany launched collections. All of these insights taken together as well as considering that the crypto winter isn't over yet, underpin that the potential and importance of NFTs for brands future marketing activities across brands and industries now and in the future.

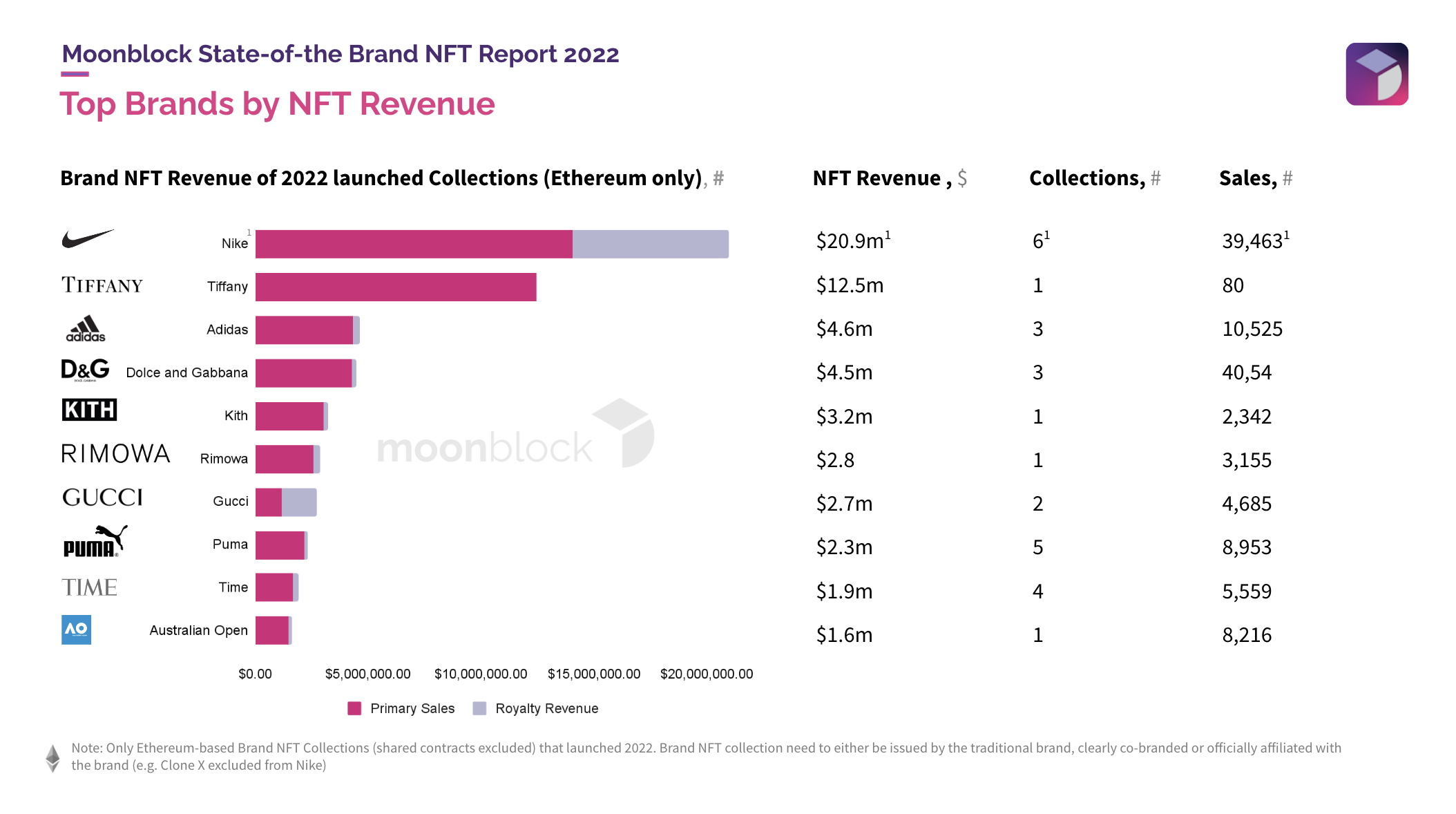

Nike and Tiffany were the clear revenue leaders of 2022 generating each more than USD 10mn of total NFT Brand Revenue

Nike and Tiffany are the undisputed revenue leaders in terms of NFT sales in 2022, both generating more than 10m USD. While the revenue is much higher for these brands compared to others, there are also significant differences in terms of both the number of collections as well as the numbers of sold NFTs, both when comparing Nike and Tiffany, but also when comparing with the others. This clearly highlights that different brands pursue different strategies in the field, e.g. in relation to the pricing of the NFTs (primary sales and royalties) and that there are multiple approaches that prove to be fruitful for brands.

The Fashion industry clearly generated the highest NFT brand revenues across primary sales and royalties in the Ethereum ecosystem

Also at the industry levels, there are big differences in terms of the revenue earned, the number of collections launched and the sales made. Fashion and beauty & cosmetics are earning the most revenue with their NFT projects. There are, however, significant differences in terms of the numbers of collections as well as the number of sales when examining different industries, which reinforces the observations made at the individual brand level previously. Another observation that was made at the industry level is also that some industries seem to be relying more on royalties than others. While it for some industries are still early days with regards to the use of NFT, this observation might point towards that some industries might have converged on an overall approach with regards to their NFT use.

Closing words and Outlook

We hope that this blog post has given you a deeper insight into the state of brands Web3 adoption (If you are craving for more, then go here: for the full report). We are currently witnessing the early days of a new technological wave bringing opportunities but of course also challenges for brands. This is just the beginning as we expect brands - just as with the adoption of AI - to gradually integrate Web3 technologies into their operations and to surprise their customers in 2023 and beyond with innovative yet authentic (digital) products and services.

While it is clear that not all of them will become the next killer application, a huge number of innovative projects die not because of lack of potential but due to a lack of measurable and quantifiable proof of success. In the end every Web3 project will compete for limited stakeholder attention, resources and budget.

By analyzing, measuring and benchmarking performance data across brands NFT projects and their customers, we can all accelerate our learning, navigate the Web3 space more confidently, and don't need to fear when our CFO sits us down.